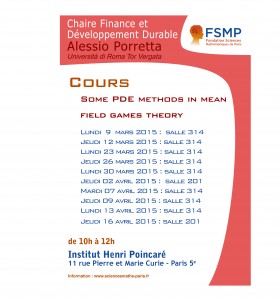

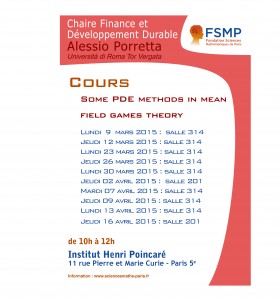

A Course by Professor Alessio Porretta

From March 9th to April 16th 2015

Institut Henri Poincaré (IHP), Paris

Mean field games theory was initiated by J.-M. Lasry and P.-L. Lions since 2006 in order to describe control processes with large number of agents (say, a population of identical individuals) whose strategy is influenced by the overall distribution of the agents. The macroscopic description, suggested as an asymptotic regime of Nash equilibria of N-players games when N goes to infinity, is given in terms of a new system of PDEs, where a backward Hamilton-Jacobi-Bellman equation (describing the individual strategy) is coupled with a forward Kolmogorov-Fokker-Planck equation (describing the evolution of the distribution law). The goal of this course is to present several problems and methods recently developed in the study of those systems, addressing questions such as the long time behavior and its connection with the turnpike property of controlled systems, the optimal transport of the distribution law, the well-posedness of weak theories and other possible related directions of research.

Further information on the FSMP Website

Sophia Antipolis (France) – March 30-31, 2017

Sophia Antipolis (France) – March 30-31, 2017

A lecture by Jean-Paul Renne (Université de Lausanne)

A lecture by Jean-Paul Renne (Université de Lausanne)